Order Flow and Price Action is the most powerful analysis combination for day traders. Outside of course of buying and front running orders or insider information.

Order flow analysis covers a variety of techniques like time & sales, volume profiling, option flow and so much more.

Price action patterns give clues into which market participants are in control. Price action patterns with order flow events are indispensable for traders to identify the best opportunities.

Order flow analysis software is readily available, most sophisticated tools can be included for trading at a brokerage or participating in a funded trader program.

Learn which order flow setups are most important for your trading and automate the detection of those events. I was able to trade part-time for years while barely watching the charts thanks to the automated detection of flow events.

Screen time is essential during the learning process, and highly encourage traders to put in as much time as possible following markets especially during volatile times.

Since most traders should develop their trading style that fits their risk tolerance and screen availability, it is best to experiment first and see which setups might work for you.

- Trading Risk Intro

- Order Flow Trading

- Volume

- Order Flow Velocity/Speed

- Market Profile

- Resting Liquidity/Icebergs

- Volume Ladder

- Market Internals

- VWAP

- Price Action

- Order Flow Software

- Order Flow Analysis Automation

- Order Flow and Price Action Trade Ideas

Trading Risk Intro

This is not a 100% success rate strategy hype the likes of which you see on social media. Trading with high leverage remains incredibly risky. New traders can take some of that risk out via Trader Funding Programs.

Please mind your risk and don’t let a single failed setup spiral into erasing months or years of work. We have seen some extreme moves from crude oil futures going negative to multiple limit moves.

Crypto space is extremely volatile and has to be handled with care for leveraged traders.

TAKE THE DAMN STOP LOSS, accept it as a vital and common part of the trading business and move on to the next setup. Your order flow system will find you something to do, and soon!

Order Flow Trading

Before going into multiple categories of various volume analyses, this is what I believe to be true:

Not every order flow event is a market turn, but every market turn has an order flow event.

This is in line with some general market cliches and truth’s like “don’t trade because you are bored”, “dull market” and so on. Let the market tip its hand and provide hints from bigger participants before engaging.

Volume

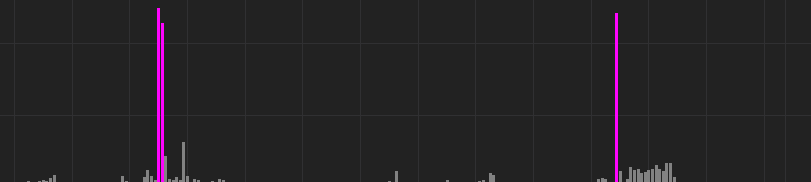

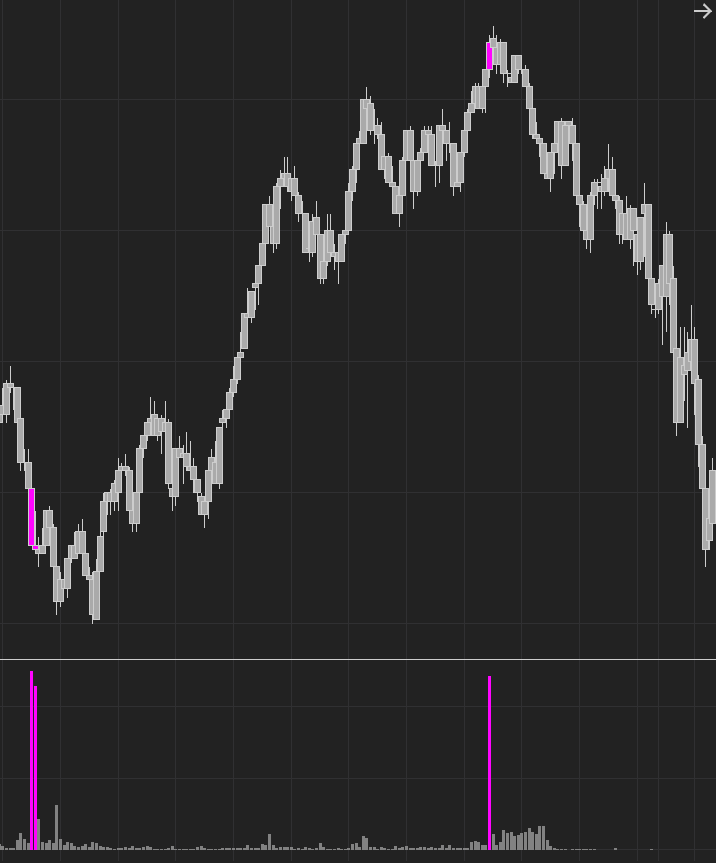

Every platform has a volume indicator. Without knowing what instrument or what price – a significant volume spike is always of interest. In this case, it happened to be the low candle of the down move.

Order Flow Velocity/Speed

Much less common than volume indicator. There are several ways to measure order velocity. Some software use speedometer type indicators, some have the pace of beeps track the pace of order volume. I use a custom velocity indicator.

It is very exhausting to stare at multiple instruments all day every day. So I have created a custom indicator that notifies me when there is a spike in order activity. I do not have to “read the DOM” or pick up on other cues, I just have the computer tell me “ES Speed” and immediately look at ES to see if it is trading in a location of interest.

As the above quote mentioned, not all volume events are top or bottoms, but most tops or bottoms happen after a volume event.

It doesn’t always work this well, but here is what those above purple order spikes hinted to:

Market Profile

Summarizing market volume and price action into a profile. Recently very popular maker analysis method. And readily available in now inexpensive software.

I use MP for the current day, the previous day, virgin day for templating, as well as composite market profile of the area where the market has recently traded.

Please see the advanced market profile techniques section for much more in-depth uses and MP-associated tools.

Market or volume profile levels are great for use in conjunction with order flow events.

Resting Liquidity/Icebergs

Software for resting liquidity and iceberg detection is widely available and more affordable than it has ever been. It is very helpful to be aware of stacked liquidity or orders. Initiating a position before the liquidity has been traded thru is best avoided according to my trading rules.

I frequently scalp resting liquidity. It has clearly defined risk. If a level of interest aligns with being defended by liquidity behind it I prefer that set up more. Also, if the level happens to be just behind liquidity, I might move the order over to the other side to have a better chance of filling.

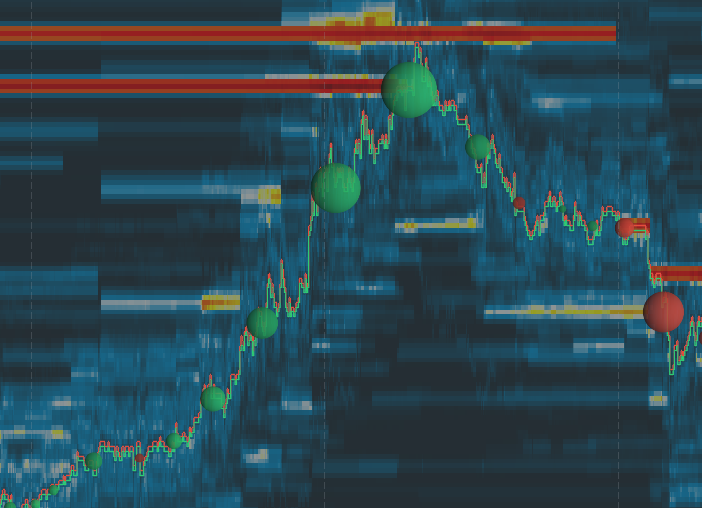

The green dots in the above image, indicate a large trade volume. From the first few things, we listed we already starting to notice price action confluences. A high volume bar coincides with resting liquidity. Two basic methods of analysis coming together already, and haven’t even gotten to the good stuff yet.

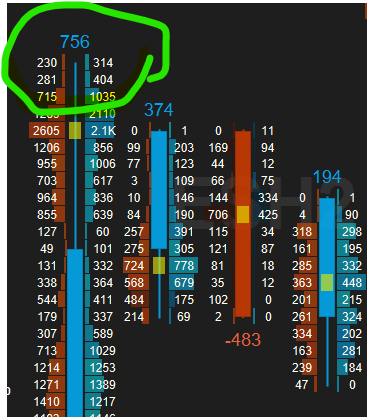

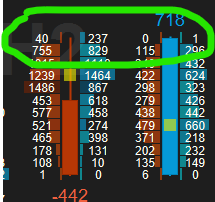

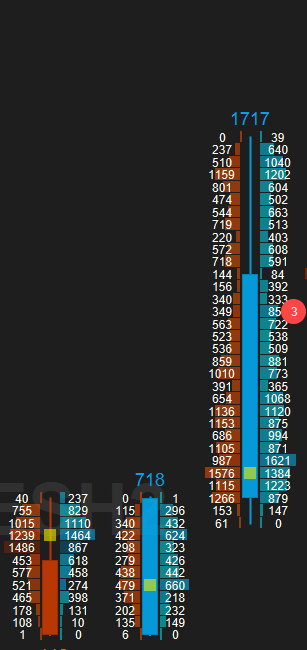

Volume Ladder

Volume ladder can be used to break down any time interval, say 15-minute candle into a table describing activity at each level. It is great to learn to in real-time fully before simplifying and only taking away the key events on the ladder. As discussed in the “Trading Volume Ladder” section of the blog, my favorites are:

- Dragging/Impulse Zeroes

- Identifying Weak Highs and Lows

Levels where the price “shows” but does not trade, results in weak highs or lows. On the Volume Footprint, you can tell it by having two non-zero amounts at the high of the move.

If level a has multiple touches and at least one is weak, I give it even more weight that the level is “weak” and will be exceeded soon.

In this case, it didn’t take long at all for the market to power through the weak high.

If I am entering at a level with a tight stop, I avoid entering when the stop is right at or near weak low/high as I expect the level to be touched or exceeded.

You’ll be surprised to find out that this is not 100% guaranteed to work. That is something I look for when assessing entry viability. Need to see very significant order flow or market internal divergence to enter with weak level pending. If I do enter, I spread out the entries to allow to add at a new level when low/high is “fixed”.

- High Delta Interest Zones

Market Internals

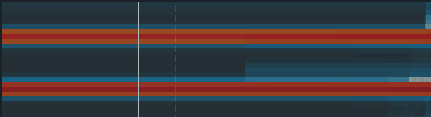

ES and other major US Index traders can get clues from market internals during the RTH session.

Advancing – Declining Issues

On-trend days, if ADV is above 2000 and driving, hands-off attempting to short, wait for internals so break down or some major resistance to be in the way. More often than not, hands-off is the best approach:

Just yesterday market internals jumped over 2000 on open and kept driving up, getting in a way of such moves is usually a bad idea.

With market internals, the same is true on down days, -2000 or worse, and driving down is not the time to start bottom picking.

Second favorite method to monitor internals is by looking for it to lead price action

In the above example market internals are driving up while the price is retracing, extra confidence in the retracement/ambush long in such situation.

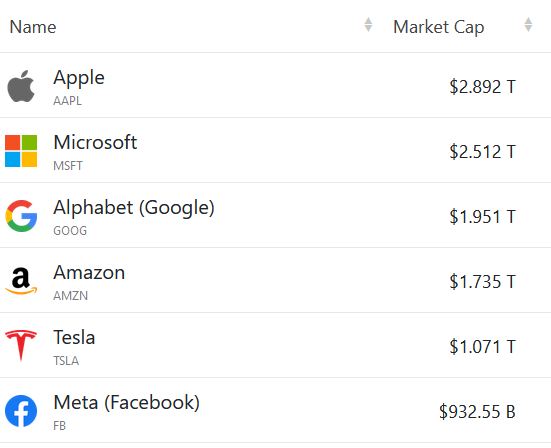

Massive market cap stocks can cause ADV to be a bit less of a leading indicator, for instance, if one of these massive market cap stocks

has a day of wild swings it might be worth hundreds of advancing or declining issues on ADV – DEC. However, it is still a good useful tool.

Tick

Short-term market strength indicator. Internals for NYSE issues trading on the up, or down tick.

Very short term strength indicator

For instance here is TICK on a 2-minute chart, with Bollinger band on it. Can use tick to improve entries whether you are leaning long or short. For longs when it is thru the lower bands, for shorts when it is thru the upper bands. Works pretty well if you prefer trading around the core position.

Using new high tick of the day in downtrends, or new low tick of the day in an uptrend.

If the market has been in a downtrend at prints new high tick of the day, the move is possibly losing steam as buyers are getting more aggressive. A clue to reduce short exposure or not to attack as aggressively on the downside.

Here is an example of NQ in a downtrend. Tick start printing some new highs on the day. Opportunity to look for retracement longs in ambush (50×61%) retracement zone or when tick loads up in the lower band.

As is the case with many of these volume and price action analysis methods, they can be used as standalone set-ups, but particularly powerful trade setups when used in combination.

VWAP

VWAP fairly popular market analysis tool. Volume Weighted Average Price can be used as:

- Daily, Weekly, Monthly, Yearly – Volume weight average is counted for the specified period.

- Anchored – volume weight average price is calculated from a chosen point. Usually significant high or low.

After an extended move up retracement back to VWAP is usually an area to look for continuation. I prefer the ambush x vwap area to look for continuation, especially if one of the order flow events takes place.

VWAP standard deviations. Most commonly +/- 1 and 2 SDs are used. I have a rule that I do not initiate new positions when the market is already extended past 2SDs. While anything can happen in the markets, more often than not there are better entry points available than chasing the market trading outside of VWAP 2SD.

Basic VWAP explainer – basic vwap reading breakdown and tips

Price Action

Support and Resistance

Basic support and resistance concepts. Previous support becomes future resistance. Previous resistance becomes support

Multiple touches of the same level are considered to be stronger level than single touch.

Bar Types

Utilize a variety of bar types available. Renko, reversal, point and figure, tick bars, and many other bar types can be a great way to consolidate price information most relevant to your trading.

Why have 20-minute bars during quiet periods take up room on the screen when they can be contained in a single Renko bar. Give me more information when the market moves.

Increased volatility

Intently staring at the screen around the clock monitoring charts for stocks, indexes, commodities, and crypto can be exhausting. Many will tell you to focus on just one instrument to maximize focus. While I agree with the premise. If you know what you are looking for, why not just relax and wait for your system to spit out a signal of increased volatility or one of the order flow events.

For instance, in the first iteration of auto analysis, I have @esecfutures Twitter account tweet out any time 3-minute candle range for ES or NQ futures exceeds the average range by a factor of 2. Extremely primitive, and does not have any filters yet. Similar account for crypto increased volatility @FindCoinAction. Trading 7 Days a week is impossible to keep charting non-stop, so why not have tweets or alert notifications when there is a relative increase in vol. Volatility tends to beget volatility. So when a signal fires off can look at the chart for any additional order entry criteria.

Impulse Moves

Impulse or large moves in a single direction indicate which market participants are “winning”. While they of course don’t always get their way. I like to pay attention to the larger moves and try to enter in their direction aligned with order flow event or liquidity level.

Rotations

I find it easiest to detect bigger rotations by using custom bars like Renko. They eliminate a lot of noise and it is easy to measure the size of the move.

I especially prefer impulse move that overlaps previous rotations and are the biggest.

Overlap and Impulse give me something to work with assuming some market participants are stuck while stronger hands are winning:

In the very high production image above, you can see an impulse down leg overlapping several previous rotations. The market then retraces into ambush area before continuation lower in direction of the impulse move.

SOS / SOW – Show strength of weakness

SOS – Show of strength or when a higher high is made.

In the chart above you can see a series of lower lows and lower highs. Highlighted higher high is a show of strength. I pay attention to such events if confirmed by order flow for potential scalp longs on the retracement.

SOW – Show of weakness or when lower low is made. Same as a show of strength but the opposite.

Candles / Bars

Candles that are significantly larger than the recent range. Like with impulse legs, I like to take note as they are frequently indications of a move coming up. Use available tools to predict the direction.

Order Flow Software

Lots of good and lightweight software is available now. Desktop, mobile, or cloud trading order flow software is ready to go. Price has also come down significantly, most of these can be had for free or under $50/month.

New traders will likely want to look around to see what fits their style bits. Experienced traders can find what they need on their current trading software, unless they are on an extremely dinosaur platform, in which case looking around can be beneficial as well.

NinjaTrader

Most popular futures trading platform out there. Can also be used for stocks, Forex, and just about anything else with a data feed.

You can try it for free at no cost.

If you participate in trader funding programs you can also use it for free for the duration and while partnered with the prop firm. With all the recent deals going on in the space might be interesting to look around and get a chance at funding.

Can custom code pretty much anything you would like using C or Ninjascript.

To get access to their full Order Flow analysis package would need to either purchase a lifetime license, lease a premium access account or become a member of their brokerage.

Ninjatrader brokerage has great RT rates and margins. Could open an account to punt around some micro contracts and get access to the software.

There also is a massive ecosystem of indicators and coders available for hire. If there is something you want, you can get it done with NT (NinjaTrader).

I use NT the most since I have been programming on it for years and it is easier to run multiple platforms than to move all the order flow and pattern recognition custom coding to a different platform.

Tradingview

During the Crypto trading craze, Tradingview was in the Top 10 websites in the USA not to mention one of the top trading platforms.

Fantastic platform, log in from anywhere and access everything from absolute crap coins to stocks around the world and beyond.

Can quickly sign up using a Google account and can get pretty far using just a free account. If you would like to utilize more advanced features you will have to pay, but the price is very fair.

There are ways to access advanced features via funded trader programs, once again, sometimes cheaper than paying price just to use. Many brokers also have access.

Traders looking to learn to code will also enjoy Python-like Pine Script. Much easier than taking on NinjaScript or some alternatives out there.

Multiple areas TradingView shines through:

- Diversity of products

- Custom coding

- Alert System – can set up email, sms, and notification alerts with just a few clicks.

- Free Features

EdgeProX

Great active order flow trader software and fantastic price.

You will be able to chat about all of the things mentioned in this article on EdgeProX, so if you are just looking for light on resources but sophisticated volume and price analysis software. Would look here first.

Unfortunately, they are not there yet if you would like to customize the platform or get wild with various event alerts.

Give them a try for free and see if they have what you need.

Traders behind the platform know exactly what order flow traders need to analyze and execute trade opportunities, so the platform is coming along nicely.

Bookmap

Many have been trying to re-create their resting liquidity and iceberg detection, but nobody has come close yet.

Bookmap is also great for execution

While it is a trading software industry leader in resting liquidity representation, it is unlikely to be your all-in-one charting solution. Unfortunate, considering the price tag is rather high by modern standards.

Bookmap Crypto is likely their top product. Inexpensive relative to futures/stocks software and provides cloud and desktop-based multi-broker liquidity analysis.

Order Flow Analysis Automation

Market analysis automation sounds overwhelming at first. Do not be afraid to jump in and start with the basics and build up from there. Most of it is basic IF-THEN statements assuming you can get access to the variables you are using as triggers.

Starting with alerts

Some people think automation means you need to create some sort of forum scouring artificial intelligence bot that beats the colo-hosted front-running predatory algos in speed. Yeah, that sounds pretty overwhelming.

Start with the basics. Create 1 alert. For example, make a sound if the volume of ES 5 minute bar is over 20k ctr.

Saw some guy claiming a 100% success rate for basic MACD crossover on Youtube during the crypto scam craze. But would like to check for yourself. Make an alert for that too.

Without coding, you should be able to set up an alert for just about any single event.

I believe you would have the easiest time starting with TradingView, but can be done with most platforms.

Now you are on your way to automating your process. What’s next?

Multiple Event Detection

You will learn pretty quickly that if you have random unfiltered alerts firing, your trading station will resemble a sensory deprivation chamber than a place of trading business.

Now you will likely have to introduce some custom coding. Filter the events to only get the alerts you need and are likely to execute during.

Don’t limit your alerts to random noises and sound bites. Make them meaningful. I currently have one of my computers set up so that it talks me through the price action, I could look away from the screen for a long time and visualize what is happening. If you cant get Adele to do it, and don’t want to listen to your own or your wife’s voice, there are plenty of text to speed free websites available that will allow you to record whatever you need.

Custom Coding

Knowing how to code is very useful. If you are not interested in learning or do not have the time, ask around, often very competent traders can make you what you need for a low price. Even at platforms that do not have custom code available, they can create a custom DLL or indicator file for you.

It is also possible that you are not the first person to see a YouTube video or get a particular idea. If you are with a popular platform like NinjaTrader or MT4/5, it is very likely a version of whatever you thought of is already out there.

Once you are at this stage of being able to filter out exactly what you need, you should be able to back and forward test your ideas in preparation for auto-execution, should you take that step. I feel as though most traders will stop at semi-auto. Let the computer do analysis, then enter and manage manually.

Order Flow and Price Action Trade Ideas

This will be a running showcase of setups involving multiple order flow events discussed here.

Day Review using techniques:

Strong Market Internal Clues – strong divergences, impulse moves, no chasing rewarded, order flows marking market turns.

Repairing the low and waiting for order flow event – morning started off with advancing issues driving up, ES had a weak low. Looked for repaired low, order flow event and market profile support to attack the divergence.

Multiple Structure Fixes – Looking at NQ and market internals leading ES and avoiding considering longs until the weak low and tick structure is fixed.

Bitcoin support resistance and resting liquidity – Bitcoin made SOS, trapped some sellers, and liquidity stepped in to protect the level of interest. The kind of setup I look for – several concepts in one setup.

BTC Liquidity Pull Setup – Using failure or trader through of liquidity to look for continuation moves in crypto currency daytrading

BTC on Saturday Afternoon – following rules and reacting to new price action info

Perfect Crude – only information on the order flow chart marks significant market turn

Weekend Bitcoin– using support/ resistance and iceberg to help facilitate traders. Recognizing rejection and flipping fast to the other side example for June 11-12 trading.

Pop n Crap Setup – common setup for popping stop around the range and then trading back into the range

Futures Price Action On Twitter

Keep an eye on development of automated price action analysis via my Twitter account – Esec on Twitter

Hope you have enjoyed the post. There are thousands of hours of content to consume on order flow, market profiling, and various price action topics. However, I managed to share 90% of what I use in my trading in just one post.

Will discuss order management and strategies around trading one in one out or building around a position in later posts.

Good luck and trade well

Vlad