VWAP is a great indicator that should be available with most of the trading platforms. VWAP or volume weight average price is weight provides average value of trading instrument based on both price and volume.

How I use VWAP in trading:

- VWAP the average itself, I believe it is highly monitored level so I look for reactions and order flow events around it. Most often used for continuation.

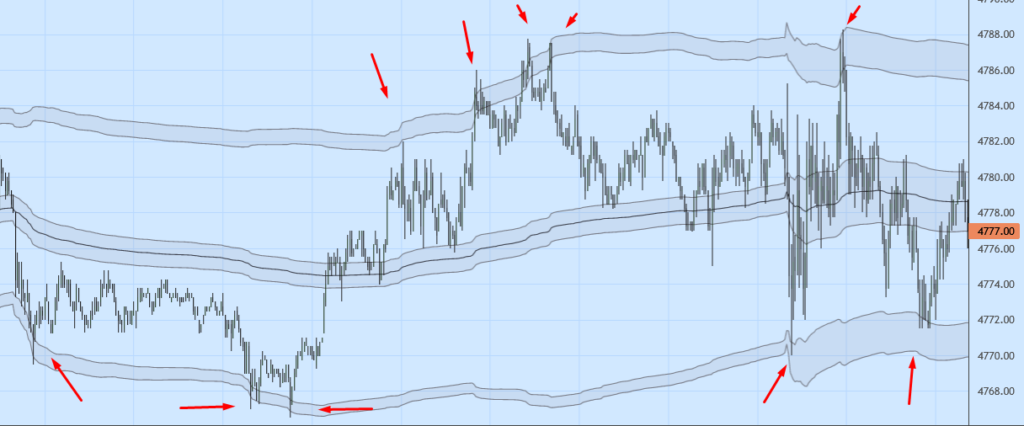

- VWAP Standard Deviation Bands – Use them to note when trading instrument is extended. Frequently band touches result in market direction clues. I find touches important enough to be alerted to on my trading platforms and share the alerts via Esec Futures Twitter account.

VWAP Band Touches

Do two standard deviation bands of VWAP always contain the price? Of course not, but it doesn’t hurt to know when the touches occur. Combined with order flow events or divergences can act as entries and exists for your strategy.

Loaded Mid x vwap touches – the ones the twitter feed is monitoring for, are when 50% retracement of the day and vwap area is touched after touching +-2 band, the area produces scalp worth reaction fair amount of the time.

The mid and vwap area can also be considered entry point to trade in the direction of larger idea or attacking a weak high or low.

I prefer continuation mid x vwap continuation trade after

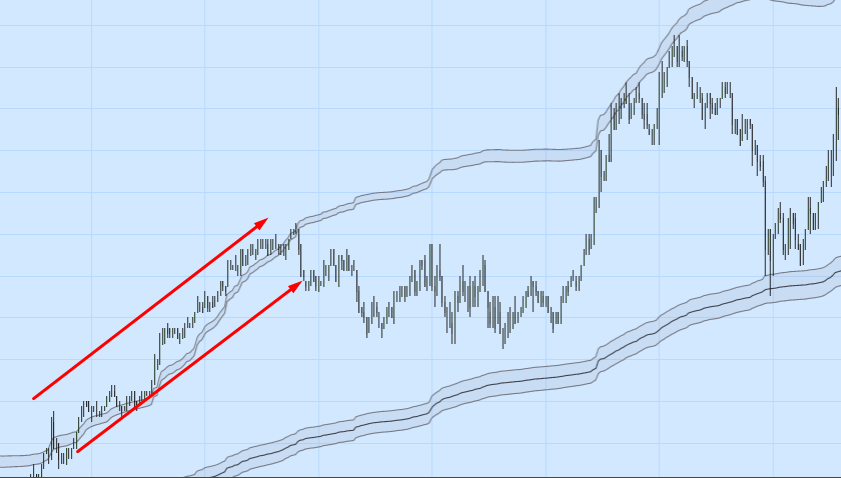

Riding the VWAP bands

Trading would be too easy if it was always like the image above. While market is often frequently rotates and goes nowhere, stronger move do take place.

I consider riding the band to be an impulse move, when a side asserts strength. I look to go with impulse move. VWAP x ambush (50 x 61 % ) retracement zone becomes of interest for continuation.

You see in screenshot above, the buyers were strong enough that opportunity to go with the move was not presented until the second touch of the bands.

I have a rule that I do not initiate position in the direction of the band ride while it is outside the band, as I prefer to enter once it is out of the bands and retraces into a support inside the bands. If I already have a position on, I might ride the band until and strongly consider trimming during

Volume Weighted Average Price Band Re-Entry / Reversal catching

Four point system before looking to fade a band ride / trend:

- VWAP band ride takes place

- Re-enter the band and get some separation. Get “air bubble(s)” between the band and price

- Touch newly calculated band

- Have an order flow event accompany the touch (see order flow)

Preferably there would also be divergence developed during this process.

1 – ride the band

2 – bubble and recalculate

3 – re-test the band

4- multiple tick divergences, ADV-DECL divergence and order flow events (not pictured)

Extra Tips and Observations:

When bands are flat and there is 3rd+ band punch, I rarely trade back towards the middle of the range. Higher chance of price discovery lower.

I use vwap for trading all instruments from Futures to Crypto. To not get bogged down with alerts of more volatile instruments I change band setting from 2st dev to 2.61 or 3. Let me know when things are getting really spicy.

Can also use weekly, monthly or anchored average calculations for larger time frame calculations. I strictly day trade, so mostly use current day vwap.

Will keep this refreshed with examples and trade ideas with time. Also aspire to have running stats shared on here for all the touches, rides and ambushes.

Cheers

Vlad