Hey Traders,

After once-in-a-decade July lift off and continued momentum push through August, capped off by last week’s opex shakeout with a push to new highs, markets are now in the ignore zone, where good/bad news, earnings, currency events simply do not matter in the face of momentum and performance chasing funds.

For a month now market sentiment is at multi year highs and internals point to levels not seen in a veyr long time, namely stocks above 200 day moving average:

So now that “recession is over” as im told by CNBS, might as well pass it on:

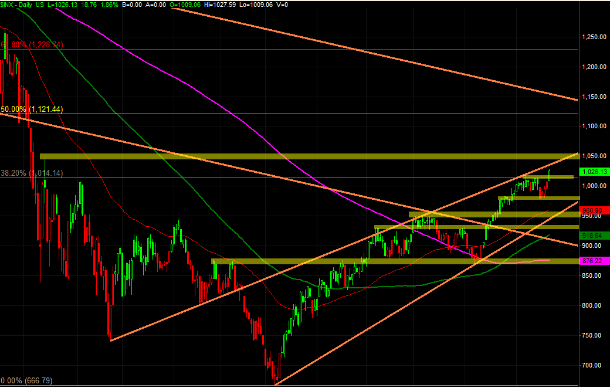

Lets zoom out several dozen years and see where we are in the big picture:

The backtest of the channel lines up right with October 2008 high (not that this high is a critical level, but bears are grasping for straws as far as resistance levels here) with the wedge resistance right below:

If bears to decide to put together a pullback of more than 2% off of yearly highs, here are the support levels to watch:

The chart is pretty self explanatory.

Again, will be watching dollar closely, as it seems to be forming a box:

The top of the range is laminated with 50ema and channel right above, on break of both could see a bigger move up as dollar related sentiment is also EXTREMELY bearish and trade seems to be overcrowded.

Will post smaller time frame s/r levels for ES in the morning and as always will keep posting intraday market technicals & internals updates via my Twitter account @esecfutures

Good luck and good trading to all

Vlad

p.s.

next week is the last week of summer, which means we are likely in for some low volume choppy action.