Even though I personally do not trade long term, or even swing trade, it is always good to know where we are on the weekly time frame:

ES has put in a first green weekly trend candle, if we do resolve to the upside this week producing another green candle that would be rather bullish with potential to go as high as 940 to retest those highs. Also worth noting, ES is at overbought levels not seen since October 2007 on the weekly charts, even though not at extreme overbought levels just yet, so more upside is certainly a possibility.

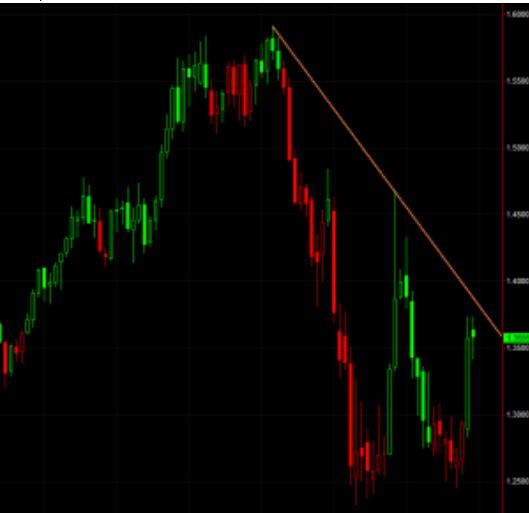

Weekly Euro:

Euro weekly put in a what looks like could be a reversal / topping candle.