Update 9pm EST:

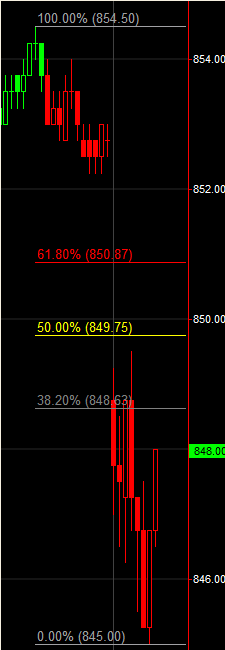

considering 845 overnight low holds, will be watching 849.75 for further clues, if that ambush doesn’t hold , gap fill and retest of highs likely

Update 7:12pm EST:

if you have missed it, here are some rather significant news from the weekend:

GS Mulls MultiBillion Dollar Share Sale

Goldman Sachs Share Sale to Repay Treasury Could Pressure Banks

As far as ES goes, it has gaped down at futures open currently trading -5.50 on the session and is testing recent uptrend line.

If ES continues lower, first support is expected at 840, which is Ambush long and also previous support from Friday. Shall ES recover losses and continue higher, besides the retest of the 854.50 rally highs, there is no resistance I see until 870 level

Update 6:55pm EST:

watching 1.32 level on the Euro for further direction

And also watching key 1.31 level on the downside (see screenshot below)

———————————————————————————–

Good Afternoon Traders,

for those who are too trading addicted to be able to take an eye of this amazing Masters tournament and time away from family on Easter, here is a quick pre-open futures summary.

Current Trend Summary:

All ES trends are pointing up from 2500tick chart all through two hour chart, with hourly ES emini chart trading above upper boundary of weekly linear regression channel suggesting the move might be overextended short term.

Euro is bearish on all time frames, but is only 56 ticks above 1.31 levels where it is expected to find some short term support.

Will be watching ES 2500tick chart for short term clues to see if it can stay above recent uptrend line, if broken will consider more short set ups, as there is no reason to get in front of this at the moment:

Good Luck and Good Trading to all this week

Vlad