Hey Traders, long time no post, with volatility and other projects too busy to put anything too coherent together

Nothing new on this particular setup, just combining multiple concepts from the Order Flow and Price action piece, price and order flow are similar across all instruments. Even during crazy luna blow-up time and stable coins coming apart.

Concepts used in these posts:

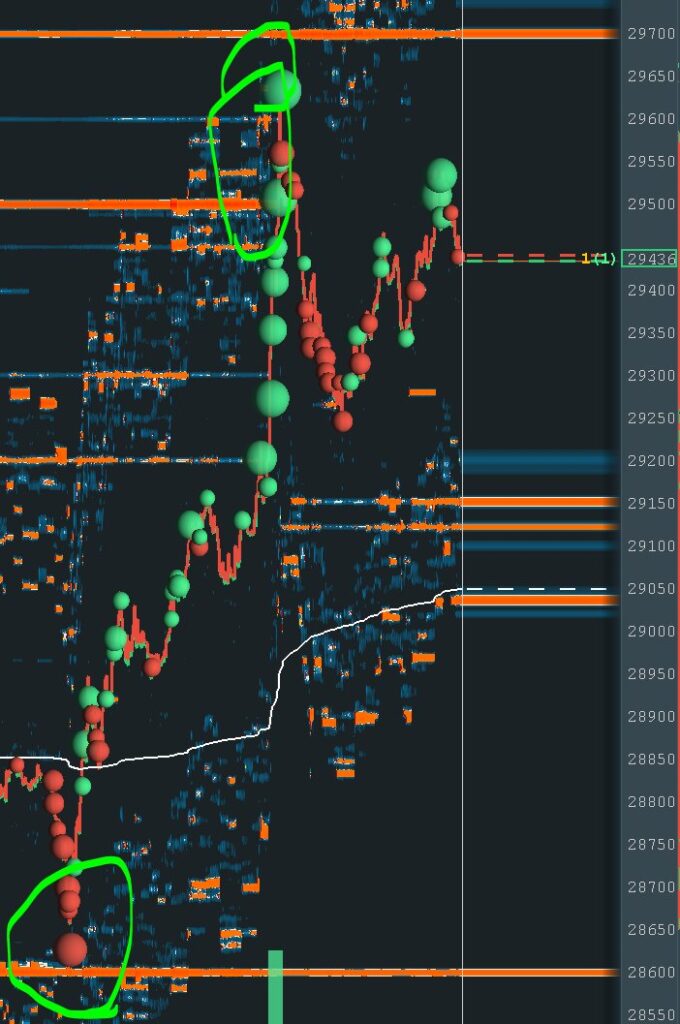

- One Tick Trick Trap

- Resting Liquidity

- Impulse

- Impulse continuation

- Vwap bands

BTC Saturday 5-14 Observations tweeted with some explanations

While being bearish BTC , always open to listen to price action.

Firstly, two rules prevented me from entering or considering shorts until new information or legs formed

- No enterin/establishing trades below vwap st dev -2 (or +2)

- NO entering into resting liquidity 28600

Price tested then poked new low slightly, toward resting liquidity, and popped right back up , clearly rejecting new lows.

We had an impulse leg up, making local higher high and eventually traveling into upper 2+ st dev of vwap and resting liquidy right above

Then had continuation in the direction of impulse leg at day mid/vwap

Few opportunities here that I traded. Rules kept me out of trouble of chasing too low and reacting to new information.

Been spending a lot of screen time tracking BTC/ETH behavior live, especially during the weekends. Will post more observations when possible. Hopefully will get on youtube soon.

Good luck, cryptos are wild these days

Vlad