Studying basic order flow and price action setups for trading Bitcoin and other cryptocurrencies I have discovered a setup that provides clear risk-reward and works pretty well.

Please note this is a day trading setup, not meant for any kind of investing advice.

Important to note you will need a broker or trading environment where you have good spreads, can’t be trading these with 150 spreads in the BTC.

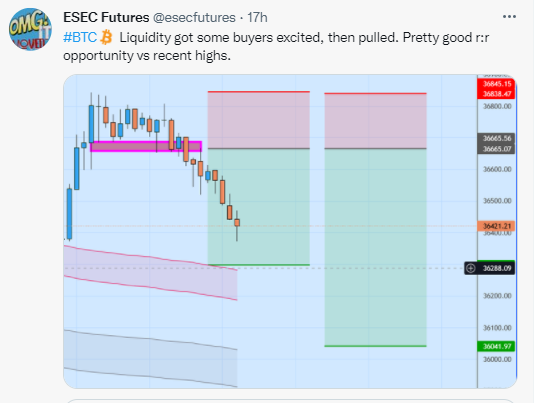

First, need a sharp move, in this case, BTC breaking through recent support levels and having one of its biggest down legs in a while.

Second, counter-trend rally:

Here BTC rallied over 1000 in 15 minutes intro previous support. Got me interested to look for continuation down.

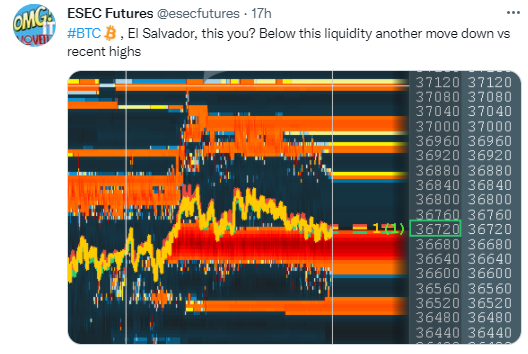

After the rally, the multi-exchange liquidity feed noticed that “they” parked an extremely thick level of liquidity right under the price. Could be a big participant, could be a spoof.

If the buyer was going to provide and lift the floor and life price to the moon, that is fine. What is of interest to me, however, is if it gets traded through, or pulled.

As mentioned in the tweet. Trading below the liquidity would provide an opportunity to short against the recent high.

The trade got triggered in and both targets were reached (not without some fine BTC whippyness)

This setup is fine for a scalp, day trade, or to use a small setup to attempt to enter bigger moves.

BTC ended up tanking a pretty significant dump from there, runner paid out nicely.

I use variations of this setup in the futures as well. Bust more often like to assume that liquidity is real. And try to use it as a defense in the direction of my position. More on that in the order flow section.

Some very nice opportunities can be found across the blockchain for weekend traders.