Hey Traders,

Not many new developments in the markets today, regardless of higher high and lower low being made. The resistance level still remains the big 1014 – 38% retracement of the bear market, along with backtests of two previous trendlines:

With intermediate term resistance level being retracement zone from the highs – ES 998.75, with break above 1001 making retest of highs likely.

Here are the support levels:

Support levels:

989s – today’s low, 1 week 61% fib and also previous s/r level

984-986.5s – 2 week 50% retracement as well as previous spike high, and 984.5 gap fill from 7/31

974-975 – 7/29 gap fill as well 23.6% retracement of the whole 3 week rally

– Will also be keeping an eye on 200ema hourly laminated with these support levels, it should also be key level, its almost been a month since ES touched it.

Everything will be up to the job numbers tomorrow 830am EST

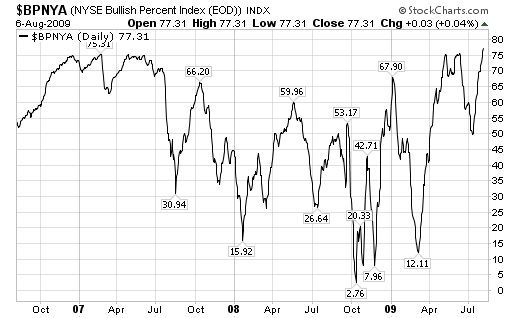

BPNYA sentiment set a new record high today, level not seen in at least 3 years, maybe ever:

This record sentiment certainly has to be a warning sign, but so far those 77.3% bulls have been right riding the wave of panic momentum buying, tomorrow should be one of most telling days in a while.

Today’s % of average range summary:

BPU09 149.0 – Huge day due to BOE

TFU09 117.2*

YMU09 116.2*

GCZ09 112.6

NQU09 111.7*

ESU09 109.3* – Indeces all traded above average range

JYU09 98.5

DXU09 98.1

CDU09 96.8

ADU09 86.4

ECU09 74.4

SFU09 66.4

For bears to get something going, they would need to break these support levels and likely put together a trend down day squeezing some of late longs without having their work be nothing more than a buying opportunity for end of day ramp up.

Tomorrow will be huge day, will keep you posted on intraday internals and technicals via my twitter account @esecfutures, now you can also find the widge with my latest update in the right sidebar.

Good luck and good trading tomorrow

Cheers

Vlad