Good Morning Traders, another case study for putting it all together of the Order Flow and Price action trading.

ES trading down on the day slightly, but internals are closer to a trend day up than they are do neutral.

Internals were driving up, however there was a problem, low was weak, there was 3x local low at 66s that was weak

Bears got a chance to attack the weak low via ambush trade (50×61% retracement) pretty fast reaction to attack the low, however if you wanted to trade in the direction of strong driving internals needed proper structure to enter.

As you now remember:

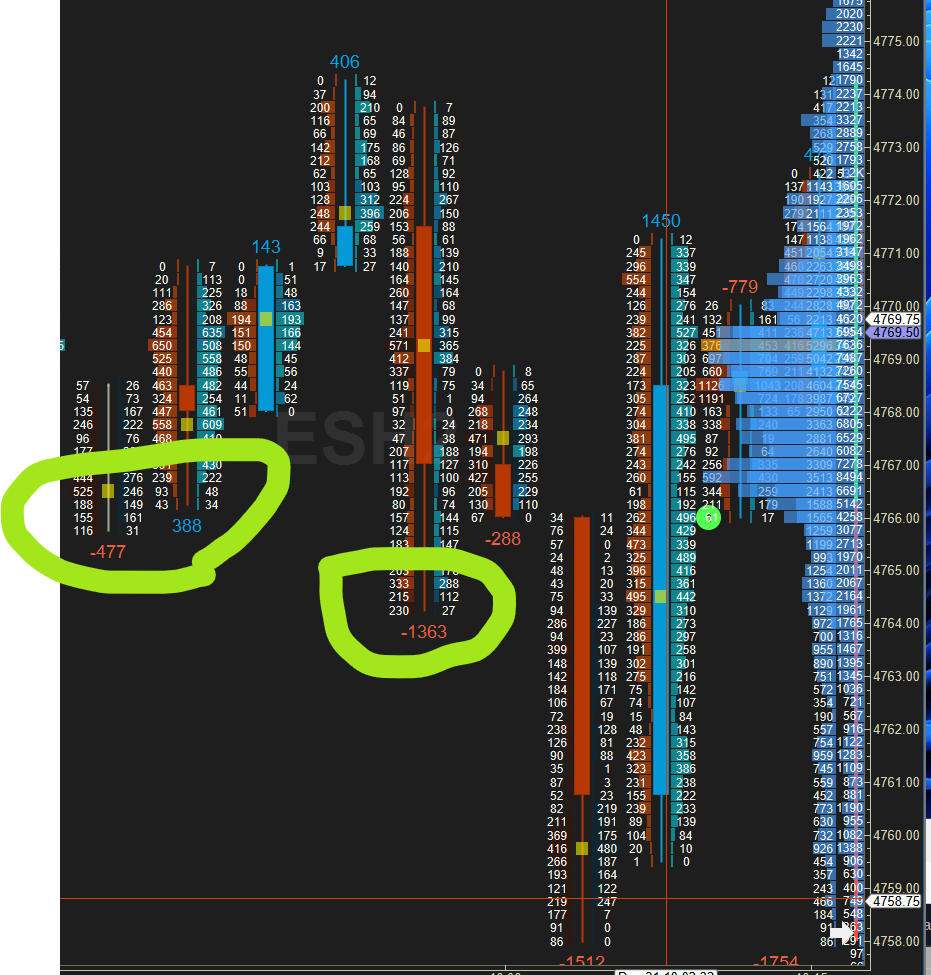

Now we need to fix the low and find the order flow event and support level to attack:

no need to even see the chart, just wait for it to buzz in one of order flow events, sure enough:

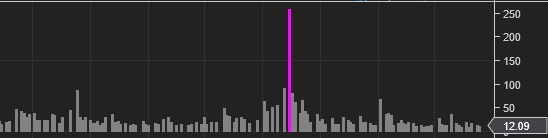

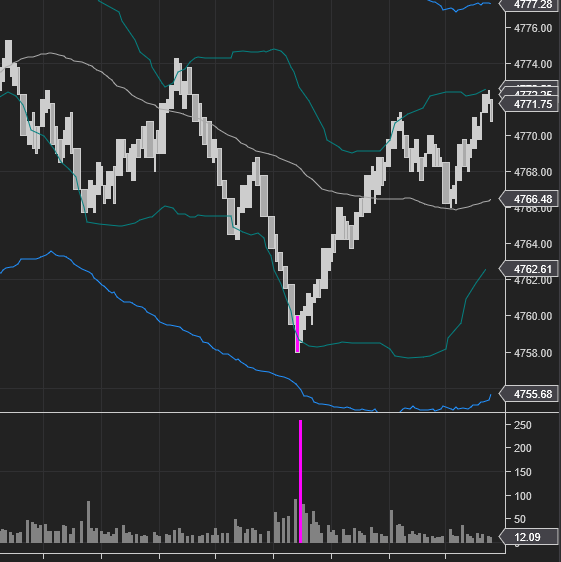

Multi flow detection system print a super spike near the low, and off it goes.

That area was also no coincidence, it was 12/27 template volume profile day VAL, IB high, and MID.

Putting several concepts from the order flow and price action piece into one good trade early on new years eve.

Happy new year and cheers

Vlad