Hey traders, welcome to Dec 29, 21 review and overview of order flow and price action concepts discussed in core piece on trading strategy.

The quote from the piece, so at the open waited for some order flow events at volume profile level, templating previous day and composite profile.

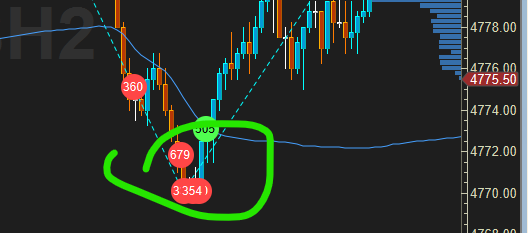

Things got really noisy at 70×72 zone, fast order pace, many blocks unsuccessfully selling into the low got stuck and market worked back.

This was bottom of what I would consider “Impulse move”

While retracement for impulse continuation was a little deeper than I would prefer, it was still playable and gave good effort to attack the low.

ADV/DEC issues or internals were pretty strong, so started getting jittery around the lows as we got a clue from tick and ADV divergence that perhaps it was not gonna be bears’ day again

ADV issues driving up, TICK making higher highs and a higher low divergent with price.

ES futures price made a small Higher high or SOS , on retracement delta, tick, or ADV didn’t budge at all. ES didn’t look back the rest of the day.

This divergence also include repair of weak local low on the footprint. Low got repaired and market show up almost 20 points giving couple half-way-backs on the way up.

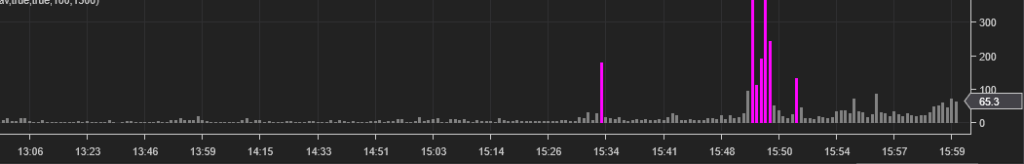

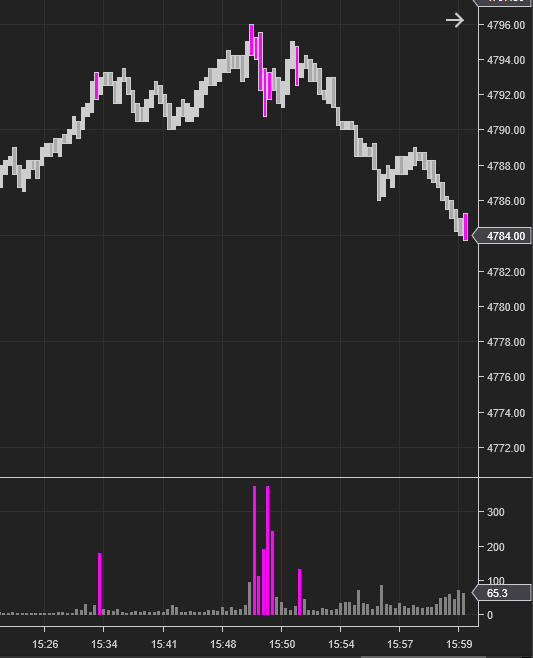

Then on the way up, especially this close bigger high, no need to change mind on direction until bigger order flow events are detected. And as you see on the graphic above they certainly were, wherever you use was probably firing off too. Lucky it turned out to market the end of the move:

ES was also contained within VWAP +-2SD all day. Rule to not initiate orders into the outside direction of the bands paid off:

Holding into existing position into +-2SD is fine for me, but initiating down there is a big no-no, unless I’m starting with a really tiny fraction of position FOMO sampler.

Will regularly add review and examples of footprint and market profile in addition to volume/order flow events and internals.

Cheers

Vlad