Hey Traders,

Another crazy week coming our way with 150+ SP500 companies reporting earnings, record 235B in auctions and plenty of econ data to spice things up.

Over the past 2 weeks bulls have completely turned things around and now are in full control.

On weekly charts we got second consecutive close back inside the old long term channel, with first resistance level another 40+ pts away:

Weekly momentum levels have reached the most overbought level of this bear market, just above previous high reading, see orange arrows.

The two resistance levels also line up almost to a point with 23 and 61% range expansion targets of the first move:

The bulls are in full above 950 level. For bears to get anything going they would have to get it below that major s/r level. And the following trendline on the hourly charts that will be ke in watching for clues before the major levels in 950s:

Will continue watching the above mentioned levels for further direction clues and trading intraday setups.

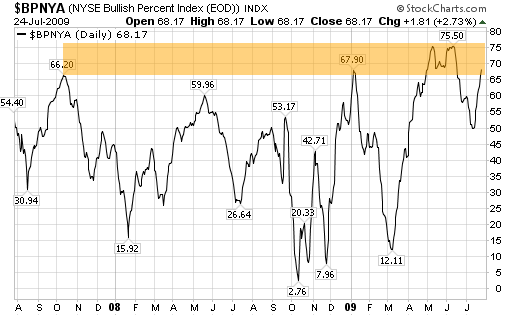

The overbought level on the weeklys and market sentiment are some wanrings signs of possible move exhaustion, here is updated chart of Bullish Percent Index, that has clearly reached extreme zone:

As always will continue posting intraday levels and internals clues in my twitter account @esecfutures as well as daily uptdates here on the blog.

Great trading to all this week

Cheers

Vlad